David Sproul’s foreword

Welcome to our Impact Report. Here you'll learn about the impact we've made for our clients, our people and society in FY17. With more than 40 inspiring stories, this report shows that at Deloitte, it's what we do that makes the difference.

In FY17, national and global politics dominated the business landscape, with the triggering of Article 50 and the UK heading to the polls for the third time in just two years. Amid such uncertainty, there is often a desire to stand still. But we saw an opportunity to take the bold decision to create our Deloitte North West Europe firm.

Bringing together over 30,000 people across the UK, Switzerland, the Nordics1, Belgium and the Netherlands, Deloitte North West Europe provides the scale, and the means, to increase our investment in the innovation clients need. It will also provide more growth and opportunity for our people, and play an important part in helping us to embed quality consistently in all we do.

Our firm has a key role to play in providing trust and confidence in the capital markets, and we’re proud to have won the mandate to provide audit services to some of Europe’s biggest companies in the past year, including BP, Intervias, BAE Systems and GlaxoSmithKline.

Our clients are operating in a more globally connected way than ever before, and are increasingly turning to us not only for advice, but also for digital and physical products to solve their problems. This year, we signed global alliances with two world leaders in the digital and technology space: Apple and McLaren Applied Technologies. Both partnerships will see us increasing our recruitment in the areas of digital design and big-data analytics, and it will therefore be critical that we can continue to access a wide range of talent across Europe. I believe that if we are to retain the diversity of skills that makes the UK such an attractive place to live, work and invest, the mobility of people should be a priority in the government’s Brexit negotiations.

As one of the largest recruiters in the UK, our firm has a responsibility to speak out and act on challenging issues – whether it’s about the future competitiveness of the UK in a post-Brexit world, or how we respond to major societal issues such as social mobility or diversity in business. In this report we explain how we are responding as a firm to these issues and the results of this action.

This year, we launched our social impact strategy, One Million Futures, which over five years aims to support one million people in the UK. We’re working with over 50 society partners to help improve education, skills and employability. Over the past year this has included supporting more than 4,800 pupils in low-income communities through our Deloitte Access programme. We have also welcomed more than 280 school leavers through our BrightStart apprenticeship programme, giving students the chance to gain a government-approved apprenticeship alongside professional qualifications.

I feel incredibly proud to see the difference our people can make through programmes like One Million Futures. And that’s why one of my highlights of the year was judging our Impact Awards, where our people share stories of the impact they’ve made for their clients, for their colleagues and for society. You’ll see many of the stories from the Awards featured in this Impact Report.

Deloitte continues to lead on the issues that matter, showing strength and decisiveness, and guiding clients through unprecedented levels of uncertainty. I’m confident not only in our future as Deloitte North West Europe, but also in the strength and resilience of our country, its businesses and its people. This report shows the role our firm can play in responding to the needs of society, by providing trust, supporting inclusive growth and building the skills of our country’s young people – it’s what we do that makes the difference.

Senior Partner and Chief Executive

- 1

The Nordics include Denmark, Finland, Iceland, Norway and Sweden

Watch the highlights

Report chapters

-

Providing trust

Find out what we’re doing to improve trust in business and in the capital markets.

-

Supporting inclusive growth

Learn how we’re helping propel growth across the UK.

-

Building skills

See how we’re changing the futures of one million people in five years.

1

Providing trust

From our continuous investment in audit quality to helping organisations comply with tax regulations across the globe – find out what we’re doing to improve trust in business and in the capital markets.

Trust in business: reversing the trend

From executive pay to boardroom diversity, the negative perceptions of corporate behaviour and culture have continued to weaken the public’s trust in big business. We believe business needs to work with government to set a vision for a corporate environment that is transparent, pro-growth and delivers opportunity for all. In our response to the government’s Corporate Governance Reform Green Paper, we called for a greater link between executive pay and business performance, with more attention on encouraging longer-term stewardship. Instead of introducing more regulatory demands on companies, we recommended businesses publish a fair-pay charter, focusing on pay philosophy and principles.

Over the year, we’ve contributed to policy debates at the highest levels, responding to various policy consultations, sharing our insight on issues such as executive remuneration, the gender pay gap and responsible tax. We also commented on the review by the Institute of Chartered Accountants in England and Wales (ICAEW) looking at trust, corporate reporting and technology in the context of the audit of the future. This review explores how the entire profession (including auditors, regulators and standard setters) needs to adapt to ensure that the audit remains fit for purpose and relevant to the changing needs of key stakeholders.

-

Story of our impact

A new tool for CASS rules

How we helped clients say goodbye to spreadsheets as our online application tackles new auditing standards.

The audit of the future: technology, big data and transparency

Technology has the potential to transform the audit process – increasing quality, insight and, as a result, trust. Cognitive technologies and analytic capabilities are changing the level of data that companies and audit firms have at their fingertips. Access to ‘big data’ presents great opportunity but also challenge: how can you channel the right data in the right way to promote trust and transparency? Our audit innovation team is finding ways to make the most of the benefits that new technologies can bring. We’ve continued to develop our patented audit analytics software, which enables our auditors to classify large data sets and perform enhanced risk assessments. By increasing the amount of data we can analyse, we’re reducing the risk of missing any anomalies. As well as contributing to trust in the financial markets, technology is also helping us improve the quality and effectiveness of our audit delivery, ensuring we can critique matters of interest with increased judgement.

We recognise that the training we provide our people needs to match such advancement in technology. Over the past year, we have run a number of innovation showcases and disruptive-technology events reaching thousands of our practitioners, giving them the opportunity to contribute ideas and shape our pipeline of tools and technologies. This commitment to developing our culture of innovation – alongside our analytics capabilities – was recognised in November 2016 through our British Accountancy Award for Most Innovative Large Practice.

Our increasing focus on innovation has also helped contribute to the growth of our audit business. This year, we successfully tendered for BP, GlaxoSmithKline, Centrica and BAE – positioning Deloitte as a leading auditor of the FTSE 100, with a 27 per cent share. Our success has also been reflected in the FTSE 250, with our market capture now at 27 per cent, with wins this year including PZ Cussons, Ferrexpo and Aldermore Bank.

-

Story of our impact

Auditor, innovator

Four (award-winning) ways we’re innovating our audit business, from analytics to automation.

-

Story of our impact

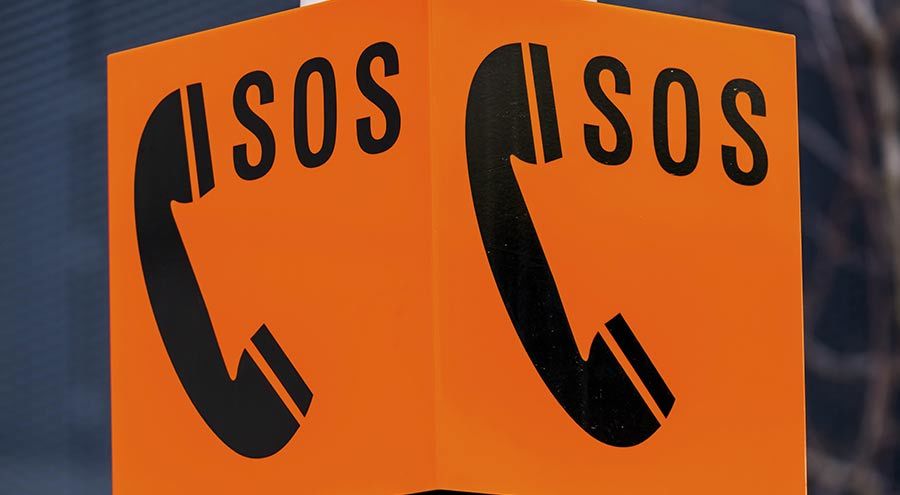

SOS Deloitte

What to do when disaster strikes? Here’s how our crisis response team helps clients cope with major incidents.

A focus on audit quality

Audit quality is an imperative for our firm. We hold ourselves to the highest standards of ethical behaviour, and do not tolerate any actions that could bring into question the integrity of our work. In November 2016, we accepted the Financial Reporting Council’s findings and subsequent fine relating to our audit of Aero Inventory, performed between 2006 and 2008. Since these audits were performed, we have significantly evolved our audit quality processes and increased investment in our people’s training.

We also continue to co-operate fully with the FRC in respect of its investigations into the audits of Autonomy Corporation (between 1 January 2009 and 30 June 2011), Serco Group (years ended 31 December 2011 and 2012) and Mitie Group (years ended 31 March 2015 and 2016).

As part of our ongoing efforts to improve the quality of our audits, we have introduced an additional layer of monitoring this year. This includes interrogation of our audit software database to track trends and outcomes, accompanied by ‘health checks’ on identified areas for improvement. These health check reviews, performed by our Engagement Quality Review professionals, provide feedback to individual engagement teams throughout the entire auditing process, and provide us with a snapshot of progress across all reviews. With our audits being regularly assessed, we can keep improving the consistency of standards.

Robots and tax compliance of the future

In today’s increasingly connected and technology-driven world, tax functions in all industries are under pressure to expand their role and scope. From meeting compliance and reporting obligations, to supporting the business in making strategic investment decisions, the tax function plays a critical role in every organisation. At Deloitte, we’re focused on what the tax department of the future will look like, identifying the key factors that will shape the profession.

One of the main forces of change is, of course, technology, and its ability to help companies make informed tax decisions and comply with complex regulations across the globe. Our tax innovation team is helping clients think about which processes could be automated or simplified, removing repetitive tasks, reducing cost burdens and, importantly, freeing up time to plan for business growth.

We're focused on what the tax department of the future will look like, identifying the key factors that will shape the profession.

The key to the transformation of the tax adviser role is the use of robotic process automation (RPA). Such technology has far-reaching implications not only for clients but also for our own business. We’ve used RPA to turn lengthy manual documentation processes into automated procedures that take a fraction of the time – for example, a robot designed by our innovation team extracted 30,000 lines of data from our systems in just 8 hours, whereas it would have taken 20 days to complete manually.

Our tax innovation team has grown from six in FY16 to thirty-five in FY17, and we’ve doubled our investment in tax innovation this year, with plans to do the same in FY18.

-

Story of our impact

The race to automate

Say hello to the robots transforming the role of our tax advisers and offering enhanced services to our clients.

-

Story of our impact

Stand out with the crowd

The Department for Education overhauled its accreditation process for family social workers, with a little help from the crowd.

Using technology to clarify the Brexit effect

Tax innovation is also helping clients prepare for major changes in the UK tax environment, such as the country’s exit from the European Union.

Businesses need to understand the impact of changes to the UK’s trading relationship with the remaining member states. This is particularly relevant in the area of customs, where there is uncertainty as to the rates and procedures that will apply to the supply of goods and services to and from the UK.

To help clients manage such uncertainty, we have created a Brexit Analysis Tool, which models potential future customs costs based on different scenarios. By allowing businesses to model the impact of, say, a lack of trade agreement with the EU, or bilateral accords with generous market access, they can prepare for some of the challenges that lie ahead, and maximise the opportunities afforded by what may be a very major change in the UK’s international trading relationships.

-

Story of our impact

Oh baby, it's a wild world

Global export is a risky game. Meet our team helping organisations reduce the chances of things going wrong.

From Brexit to BEPS, what’s on the minds of tax leaders?

As critical as Brexit is for tax leaders in planning their future tax strategy, our recent Budget survey showed that clients see the OECD/G20’s Base Erosion and Profit Shifting (BEPS) project as having the most impact on their tax functions over the next five years. The BEPS project was started in 2012 to tackle tax planning strategies that exploit gaps in tax rules to artificially shift profits to low- or no-tax locations where there's little or no economic activity. 2017 is a crucial year for BEPS, with 96 countries and jurisdictions now planning to adopt the project’s minimum standards. The UK is a leader in global adoption, and Deloitte has worked closely with both the OECD and HMRC (responding to a number of technical consultations) to fully understand the impact of the BEPS changes and help clients implement them effectively.

Because tax matters

This year, we launched 'Because tax matters', which gives our practitioners the opportunity to use their skills and tax expertise to give something back to the community. We work with two major tax charities in the UK – TaxAid and Tax Help for Older People – which give free advice to people who are on low incomes or from other vulnerable groups. Our volunteers offer in-person and telephone support, allowing the charities to help a greater number of people.

As part of our One Million Futures social impact programme, ‘Because tax matters’ also focuses on education. We’re developing material for the Business Studies curriculum with The City of London Academy to help students better understand their finances, pay slips and how tax will affect them. Some of our One Million Futures partner schools are in the most deprived areas of the country and have asked us to offer similar education sessions to parents as well as students.

‘Because tax matters’ has already seen us change the way we work with charities and social enterprises, building in more elements such as pro bono services. For example, we have created tax labs that help charities prioritise how they use resources, allowing them to keep costs down and use their donations to help those most in need.

-

Story of our impact

A superhuman effort

A look behind the scenes of how the British Paralympic Association makes sure its athletes can excel on the world stage.

2

Supporting inclusive growth

Backing the Northern Powerhouse, supporting the critical work of the public sector and investing in innovative alliances to transform our services – learn how we’re helping propel growth across the UK.

The challenge of unequal growth

From the US election in November to the UK general election in June, and the triggering of Article 50 in between, rarely have businesses had to navigate so many unknowns. In each of the four editions of our CFO Survey published this year, the proportion of CFOs who said their business faces a higher than normal level of uncertainty has been above 80 per cent. The positive news is that businesses are learning to live with increased economic and political risk, and are continuing to pursue strategies for growth.

In particular, driven in part by the debates these political events have triggered, we see business and government devoting increased attention to the issue of inclusive growth: how to improve the prosperity of our economy, and at the same time create a fairer society.

We welcomed the government’s Industrial Strategy Green Paper, and gave our recommendations on education policy, immigration, innovation, and business growth and investment. In particular, we have been at the forefront of the debate on the impact of automation on growth and jobs, helping to shape thinking within government and business on what is undoubtedly a defining issue of our times. We have liaised with policymakers on our research, which has shown a concerning trend of young people moving into jobs that are at risk of automation, rather than roles that will either be enhanced by technology or at a very low risk of replacement. We are concerned that too many young people will find their hard-earned subject-matter knowledge too academic to fill the jobs of tomorrow.

Mitigating such an outcome must be a priority for policymakers, and we have argued in our research – and in our submissions to policymakers, discussions with stakeholders and media commentary – that educators should place greater focus on cognitive, creative and collaborative skills, including problem solving and emotional intelligence. We also believe businesses should be more forthright in calling on educators and policymakers to provide the skills they need, and they must play a bigger role themselves – both directly and in partnership – in preparing the future workforce.

-

Story of our impact

AI can do it better?

What is the true impact of technology on work? Our award-winning research sheds light on the matter.

Rebalancing growth in the UK

The government has focused efforts on attracting investment across the UK, rebalancing the economy both in terms of geography and industry. As employers of nearly 6,000 people across our 22 regional offices, we see this as crucial to improving inclusive growth.

We are committed to expanding our business across the UK, and supporting local economies with devolution plans, such as our role in the Northern Powerhouse Partnership. This is a Cabinet Office initiative designed to establish partnerships with businesses and organisations to attract new jobs and investment into the north of England. Over the past year, we’ve been helping co-ordinate trade and investment plans for transport, infrastructure and nuclear power, as well as health and social care. For example, we’ve worked with Transport for Greater Manchester to develop its business case for taking responsibility for all 97 rail stations in the region.

Elsewhere, we're closely involved in creating the financial technology (FinTech) strategy for Scotland, forming a partnership with Scottish Financial Enterprise and working with universities and businesses to help the nation become a leader in the field. We’ve run industry 'hackathons' that engage school children, data scientists and banking experts to think about how technology can disrupt traditional financial services. We’re also working closely with Strathclyde University to create course content that will educate the next generation of digital finance leaders.

Over FY17, we’ve been extensively recruiting in cities such as Belfast and Cardiff. In Belfast, that investment has created 170 jobs, and our ongoing partnerships with local universities have seen us welcome 40 apprentices to our office in the city. Our Centre of Excellence in Cardiff, which provides an extensive range of research and administrative services in support of our client-facing staff in the UK, now employs over 650 people, with plans to continue recruiting until at least 2020. The Cardiff team won two awards at this year's Welsh Contact Centre Awards, including best apprentice from the Tax International Assignment Services Centre of Excellence and Support Team of the Year for our Audit Engagement Support Centre.

-

Story of our impact

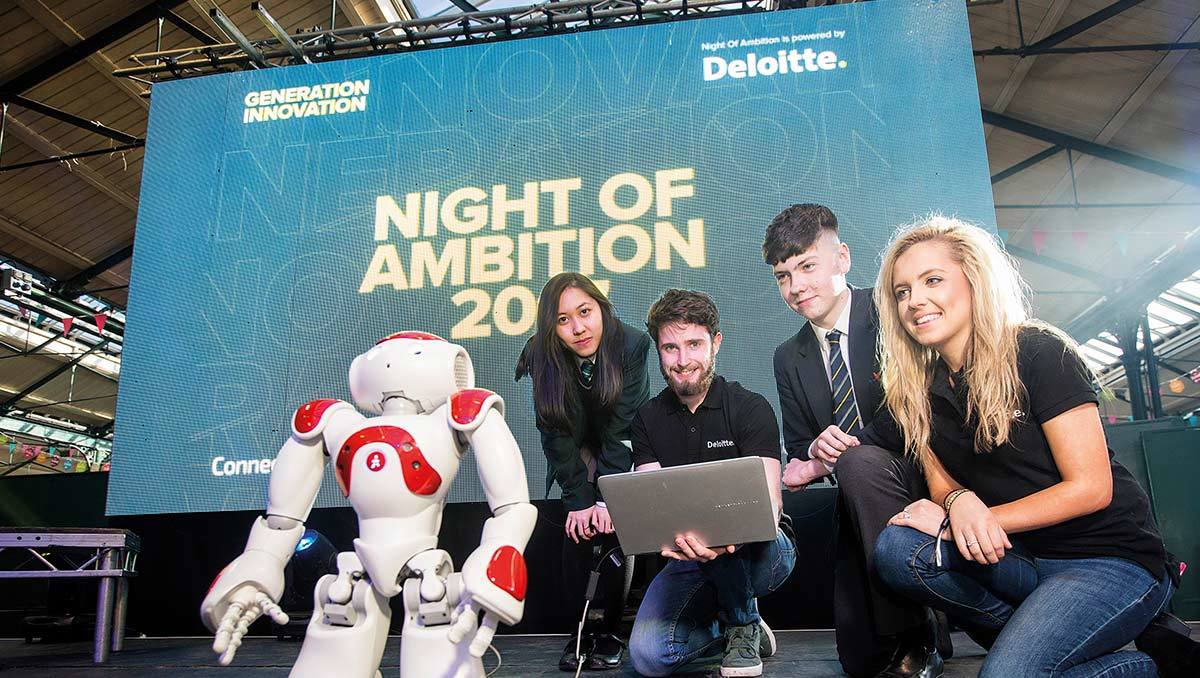

Belfast's year of ambition

It’s been a great year helping Belfast build the skills they need to grow the city on the global stage.

The role of business and government in inclusive growth

More than ever, the public sector is playing a lead role in fostering inclusive local economies, and we are proud to support this crucial agenda. We’re working with the public sector across transport, education and housing, as well as supporting people with education and employability – all helping to secure the growth and boost the productivity much-needed in the UK.

The public sector has had to adapt to pressurised financial circumstances, increasing demand for services and new challenges such as Brexit, all while continuing to deliver the frontline services UK citizens expect. We have supported our public sector clients with various challenges – from creating a new strategy for Police Scotland, to helping NHS Trusts improve staff planning to

keep costs down.

Some of the challenges currently facing the public sector are also being played out across private industry. For example, cyber security and responding to the increasing threat of cyber attacks have been mounting concerns among business leaders. The global ransomware attack in May this year immobilised businesses, closed hospitals and disrupted transport networks. Within hours of the Wannacry outbreak being detected, the Deloitte Cyber Intelligence Centre provided ten crisis management teams to give immediate pro-bono support to NHS Trusts. We’re now working with Trusts to help them understand and mitigate the risk of something similar happening again.

Our research has shown that while in 87 per cent of companies in the private sector the board considers cyber threat a principal risk, just 5 per cent of those same companies have someone on the board with direct specialist technology or cyber experience. We expect this mismatch to change as organisations increasingly provide greater disclosures on their cyber-resilience plans. Our cyber team, which has grown by 40 per cent over the past year, predicts increasing frequency and severity of attacks. They’re working alongside our 1,800 cyber practitioners across Europe on projects as diverse as advising one of the world’s biggest banks on its cyber security programme to helping a global healthcare group control the risk of data loss.

-

Story of our impact

Ready for take-off

Come take a peek at how we’re building business strategies for the UK’s aerospace and nuclear suppliers.

-

Story of our impact

Planning ahead

In the face of a nationwide housing shortage, this team is helping Manchester deliver the homes it needs to grow.

Changing the way we work

From the public to private sector, industries are changing the way they work to take advantage of technology, respond to the uncertainties and opportunities of Brexit, and adapt to a fast-changing marketplace. Our response to these issues is reflected in the creation of Deloitte North West Europe. This combination of our member firms in the UK, Switzerland, Belgium, the Netherlands and the Nordics will not only increase the growth potential of our own firm, but also strengthen our ability to support the growth of our clients, who are operating in a more globally connected way than ever before.

As clients turn to us to find ways to make the most of advances in digital and technology, our greater scale will mean increased investment in more innovative services. One example is the launch of our Connected Store. This installation at our Deloitte Digital office allows retailers to understand how the future of digital technology will affect their business and customers, giving them a tangible way to adapt their business to the future of their marketplace.

Rather than simply sharing our knowledge and insight into industry trends, we take the client through the entire customer journey and immerse them in the technology that can help reduce costs and improve productivity. We’re progressing the Connected Store to now feature Apple technology, including Apple Pay and its new loyalty app. Connected Store 2.0 is an exciting step forward in creating a more comprehensive view of the entire retail business – it looks at the store from the eyes of the consumer (where are the products they want?); the employee (how much stock is on the shelves and where is it?); and the store manager (sales targets, number of staff). This all-encompassing view allows the client to better understand and manage performance.

We continue to invest in disruptive technologies, such as artificial intelligence, to take exciting products and capabilities to our clients. For example, a team in our Risk Advisory practice developed a solution to help organisations monitor conversations with their customers and highlight any that have the potential for mis-selling or delivering poor customer outcomes. BEAT (Behaviour and Emotion Analytics Tool) is an outcomes-based voice analytics application that uses a machine-learning platform to analyse telephone calls. The application ‘listens’ to different types of audio interactions and doesn’t just analyse what a customer does or doesn’t say, but also how they’ve said it and the emotions conveyed. For example, the application can identify potential vulnerability or confusion, which allows organisations to intervene earlier and offer a different treatment for customers if necessary. Funded by our investment in innovation, BEAT was developed from idea generation stage through to client readiness in just eight months. BEAT is part of a broader portfolio of products we are investing in to future-proof clients’ businesses and provide ongoing opportunities for growth.

-

Story of our impact

Now you're talking

Helping Roche scientists communicate across the globe to deliver what matters.

-

Story of our impact

'B' is for better banking

Proudly presenting a revolutionary new banking app that puts your finances at your fingertips.

Alliances: a new approach to market

This year, we signed alliances with two highly innovative organisations – Apple and McLaren. Through our partnership with Apple, we’re helping businesses embrace the iPhone and iPad – technologies that have predominantly been the preserve of the consumer. For example, we’re helping organisations use the technology in customer-facing functions such as retail, hospitality, consumer banking and healthcare, as well as within organisations for recruiting, training, managing the supply chain and in back-office systems such as finance.

In May, we signed a global partnership with McLaren Applied Technologies to build data-driven business products. This partnership combines McLaren’s engineering, sensor and simulation technology from the world of motorsport with our experience in analytics and delivering large digital consulting projects globally. The products will combine technologies such as advanced sensing, real-time simulation, predictive analytics, artificial intelligence, cloud and cyber security. These will allow our clients to collect, analyse and use the huge amounts of data being generated by the Internet of Things (IoT) within their business. The uses of such technology are vast: using wearable technology to monitor a patient’s vital signs remotely; using sensors in production lines to improve drug quality and compliance for pharma companies; and real-time supervision of complex road and rail networks to improve scheduling, traffic management and accident response time for the transport industry.

As part of the partnership, 150 new jobs will be created for people with experience in product and software development, data analytics and data science, the Internet of Things, machine learning and artificial intelligence.

-

Story of our impact

Banking with blockchain

Creating a contactless blockchain smartcard for Metro Bank.

3

Building skills

Raising aspirations, improving skills, and helping people overcome barriers to education and employment – see how we’re changing the futures of one million people in five years.

Introduction

The work we do in providing trust in the financial markets and supporting inclusive growth relies not only on the people we employ and develop, but also on our commitment to encouraging positive social change through business.

This year we launched our new social impact strategy – One Million Futures (OMF). Over the next five years, we will help one million people get to where they want to be, whether it’s helping them in the classroom, the workplace or the boardroom. By bringing together the whole firm to focus on one impact goal, we want to raise aspirations, improve skills and develop leaders.

In year one of the OMF programme, we have supported 138,000 people and developed a robust measurement framework to ensure we are maximising our impact. Over FY17, 3,400 Deloitte volunteers have supported the programme, and we’ve raised £511,000 for various charities.

Our OMF strategy is brought to life in three key areas: people, society and clients.

-

Story of our impact

Nurturing the tech talent of the future

Award-winning women of Deloitte pioneering careers in technology.

-

Story of our impact

Context is king

Yes, context does matter. Here’s how we’re levelling the playing field for everyone applying to work at Deloitte.

People: thriving through diversity

Equality of opportunity is vital to our firm’s success, and is the foundation of a fair and inclusive society. The past year has seen significant focus on advancing diversity in all its forms in our business.

We are a vocal supporter of the government’s gender pay legislation, which came into effect on 1 April 2017. Having voluntarily published our gender pay gap twice before – in 2015 and 2016 – we published it again on 26 July 2017. The current mean gap stands at 18.2 per cent (median 15.3 per cent), and is due to the lower proportion of women holding the firm’s most senior roles – an issue that we’re working hard to address. Women made up 19 per cent of our UK partners as of 1 June 2017 – an increase from 14 per cent in 2014 – showing we’re making progress towards our stated target of 25 per cent by 2020.

We continue to prioritise the retention and recruitment of senior women, and were the first firm in our industry to introduce a Return to Work programme, designed to help women who’ve been out of the workforce for an extended period return to a professional career. Following a successful pilot, we’ve since doubled the size of the scheme, attracting more than 1,000 applicants for our 20-week programme this year. Of the 25 women to have participated in the programme since its launch, 16 went on to join the firm in a permanent or contract role.

We are working to a plan that we put in place in 2014 to increase gender balance at all levels. Our recruiting processes, marketing and targeting activities have all been adapted to address any unconscious bias, and support our aim to move towards an equal intake of men and women at entry level. We have set up sponsorship programmes for senior women in all four of our service lines, enabling the participants to be supported by a senior sponsor. We have also continued to focus on our culture – ensuring that we provide all our people with a working environment that not only enables a successful career to be balanced with interests outside work but is also inclusive and underpinned by respect. Such efforts to improve diversity in our firm are also reflected in the efforts we’ve made to recruit from different socio-economic backgrounds, as outlined below.

We have contributed to the wider debate on gender diversity with government, our clients and through the media. In FY17, we published research that found, at the current rate of progress, the overall gender pay gap in the UK would not close until 2069. We called for action from all stakeholders in this debate, stating our collective responsibility to help inform girls of the impact of their educational choices and to encourage more girls to study STEM (science, technology, engineering and maths) subjects during their later school years.

The work we have done on this issue has been widely recognised. Deloitte was once again named as one of The Times Top 50 employers for women, and our Chief Executive and Senior Partner, David Sproul, was named by Management Today and the Women’s Business Council as a Male Agent of Change for his efforts to promote gender equality.

Yet gender is not the only lens through which we focus our diversity actions. This year, we have also agreed targets for the proportion of our partners who are Black, Asian or Minority Ethnic (BAME). At present, 19 per cent of people from our business are BAME, but just 5 per cent1 of our partners. It’s clear that some of the challenges we face in improving gender diversity at the top are present in improving BAME representation as well. In line with the Parker Review, we’ve committed to increasing the proportion of UK partners who are BAME to 10 per cent by 2021. In addition, we will have at least one BAME member on our Executive, and within each of our UK business leadership teams.

More broadly, our diversity networks continue to go from strength to strength. Over a third of Deloitte partners and staff are now members of at least one of our ten networks that support our people across gender, race, religion, sexual orientation, disability and parenting responsibilities. In March, all our diversity networks joined forces across the UK in our first ever cross-network event series to celebrate the progress we've made as a firm in building a truly inclusive environment.

Underpinning all of our diversity initiatives is a focus on creating a culture that allows all people to thrive at Deloitte. We've had a long-running focus on being open about mental health issues in the workplace. We know it can happen to anyone, at any time, so we have trained mental health champions, led mindfulness courses and shared stories of our people’s own experiences to make mental health part of everyday conversation. We were one of only five businesses in the UK awarded Silver in Mind's inaugural Workplace Wellbeing Index.

We also continue to support agile working, helping our people to balance a successful career with their commitments outside work. To date, 700 of our people have taken part in (or are applying for) our award-winning Time Out programme, which offers four weeks of unpaid leave each year.

- 1

This number is UK only and does not include our Swiss practice

-

Story of our impact

Just be yourself

Here’s how we’re celebrating diversity and individuality in all our people.

Society: Leading on social mobility

Improving social mobility remains a huge challenge for the UK, and tackling it is one of the focus areas for our One Million Futures strategy. Our research has shown that students from the least advantaged backgrounds earn, on average, nearly 10 per cent less than their most advantaged peers six months after graduating from the same subject. This social mobility pay gap can go as high as 15 per cent, depending on the subject studied.

We have called for action to improve access to education, ensure equality of employment opportunities and equip young people with the skills they need to succeed in a digitally driven economy. We’re beginning to see some positive change. In hiring, for example, greater use of contextual information, blind recruitment and better training for interviewers are all starting to give more young people a chance. Over the past few years, we have brought in such changes to the way we recruit at Deloitte. These are already making an impact on our recruitment, and in 2017 we hired 111 students from low socio-economic backgrounds through this specific initiative – equivalent to 6 per cent of our annual intake.

In 2017, we welcomed more than 280 school leavers directly through our BrightStart apprenticeship programme. This gives students the chance to gain a government-approved apprenticeship alongside professional qualifications. We also signed an agreement with Ada, the National College for Digital Skills, to develop the Higher Level Apprenticeship in Digital Innovation. The new course will teach students digital skills including programming, machine learning and artificial intelligence, 3D modelling and data analytics. We’ll start to send our BrightStarts to Ada in October 2017.

Greater use of contextual information, blind recruitment and better training for interviewers are all starting to give more young people a chance.

It was fantastic to see all our efforts towards improving social mobility recognised by our ranking in the Top 50 employers in the UK's first-ever Social Mobility Employer Index. This joint initiative between the Social Mobility Foundation and Social Mobility Commission ranks Britain's employers on the actions they are taking to ensure they are open to accessing and progressing talent from all backgrounds.

Through our OMF programme, we’re working with 54 charities, social enterprises and schools – each having been selected for its strong local impact and ability to improve education and employability outcomes for a range of beneficiaries. We provide these organisations with a package of support comprising pro bono work, volunteering and fundraising, all focused on maximising the impact on the futures of those they work with. Our people have provided challenge, support and guidance to ensure our partner organisations gain the maximum value they can from working with Deloitte, alongside supporting their organisational growth and development.

-

Story of our impact

All aboard, digital pioneers!

Developing Ada's Higher Level Apprenticeship in digital innovation.

-

Story of our impact

Bright young things

From low aspirations to the top of the world – here’s how we’re inspiring disadvantaged students from Milton Keynes.

Clients: advising the leaders of tomorrow

Businesses of the future will only thrive with good leadership, and we are seeking to shape that generation by supporting those with the talent and determination to take on such heavy responsibility.

The Deloitte Academy board programme has been designed to contribute to good governance and effective leadership at board level. This programme, established in 2006, includes a series of briefings and bespoke training sessions for boards, committees and individual directors. This year, we welcomed over 180 FTSE 350 directors who took part in briefings ranging from cyber risks, to Brexit, and audit committee effectiveness.

The Deloitte Academy also supports increased diversity at board level through the Deloitte Academy ‘Women on Boards’ and ‘BAME on Boards’ programmes. Women on Boards, which was launched in 2011, seeks to support the career development of women who aspire to take on a boardroom role. We have completed the seventh series, with around 30 women taking part in the education and networking programme, which involves a series of seminars over a six-month period. Thirty per cent of our Women on Boards alumni have now successfully gone on to obtain Non-Executive Director roles. Mirroring this programme, this year we introduced BAME on Boards to add further support in achieving greater diversity at board level. Our managing partner for innovation, Vimi Grewal-Carr, was recognised for her contribution to ethnic diversity in the EMpower 100 Ethnic Minority Leaders list published in the Financial Times in May this year. The list champions ethnic diversity in business and identifies individuals who have made a significant contribution to ethnic minority inclusion.

This year marks the tenth anniversary of our Chief Financial Officer (CFO) Programme, which supports CFOs along their career journey. Our Next Generation CFO workshops, launched in 2008, help finance leaders to understand the breadth and complexity of the CFO role; our CFO Transition Labs, which we started in 2011, enable CFOs to hit the ground running as they move into their role; and our CFO Network enables finance executives to foster connections and navigate the myriad challenges faced by today’s CFO. Over the past ten years, more than 1,000 finance leaders have come through the programme, including 36 from the FTSE 100.

Following the success of the CFO Transition Labs, we’ve expanded the labs to cover all the key areas of C-suite responsibility, including M&A, chief information officer and chief compliance officer. Since launch, our labs have helped over 400 executives put in place their 180-day plan, which prioritises their efforts to ensure a strong start to their role and the most positive impact on their business.

This year saw the launch of our Chief Executive Officer (CEO) Transition Lab – a personalised one-day workshop where we help CEOs frame their priorities, assess their talent and organisation, and identify different approaches to manging their complex stakeholder relationships. The content of the Lab was based on a series of interviews with over 30 CEOs of FTSE 100, 250 and private companies. It is also based on our experience of the past seven years where we have helped hundreds of transitioning executives. The interviews formed the basis of our CEO research ‘Into the driving seat’, which introduced our framework to describe the key aspects and challenges of the CEO role.

-

Story of our impact

Home, C-suite home

Here’s how we helped Burberry’s CFO and COO settle into her new role.

Stories of our impact

4

Our green journey

Green expectations

As a firm, we don’t just make an impact on our clients, our people and society. We also have an impact on the environment. This is something we’re always looking to reduce, and that’s why we launched our environmental sustainability programme – our Green Journey – back in 2011, and set ourselves some tough ten-year targets.

We just passed the half-way stage, so this year we took a moment to make sure

we’re still focusing on aspects that matter most to our stakeholders and our firm,

by conducting a materiality review.

Tackling climate action

The global impact of climate change was a shared concern arising from our review. Reducing carbon emissions is a priority for governments and businesses alike, and for us that includes tackling both our real estate planning and business travel. We’re targeting a fall in carbon emissions by 35 per cent per full-time employee (FTE) by 2021, and have hit a 40 per cent drop by the end of FY17. We additionally procure 100 per cent green electricity where we are responsible for the energy contract as part of our commitment to supporting the growth of a low-carbon economy.

In our materiality review this year, our stakeholders flagged the value of supporting the evolution of sustainable cities through our real estate programme. Our energy emissions have fallen by 75 per cent per FTE to date, exceeding our ten-year target of 40 per cent. Our water use is down 12 per cent per FTE since 2011, although it did rise this year as we increased the use of our office spaces. We ensure our office fit-outs are certified for their high levels of environmental design, and we’re piloting wellbeing design concepts in the fit-out of our new flagship office at 1 New Street Square, which we hope will deliver health and productivity benefits to our people.

Responsible consumption was another important issue for our stakeholders. This year we used 26 per cent less paper per FTE (down 61 per cent from 2011) thanks to improvements in technology such as secure printing and high-definition screens. Our waste arisings are down 25 per cent per FTE since 2011. To continue to improve resource efficiency and improve our recycling rates, we are reviewing our procurement of goods with a view to moving to a more circular consumption model.

The way around business travel

There is a fine balance between our desire to be on-site with our clients and our aspirations to reduce the impact of travel on the environment and our wellbeing. Travel is intrinsic to our business – we serve clients across the globe – so unsurprisingly this makes up 75 per cent of our carbon emissions. We struggled to make a reduction this year, largely due to the additional travel required for the creation of Deloitte North West Europe. We keep looking for ways to decouple business travel from business growth – for example, through enhancing our video-conferencing and online collaboration tools.

We estimate the emissions associated with our supply chain are at least the equivalent of our current footprint. We don’t currently report on these as the data is not reliable enough, but we believe there is still value in engaging and collaborating with our key suppliers on sustainability issues.

Our sustainable procurement policy is there to help us ensure our supply chain increases both environmental and social benefits. We’re now pushing on by scoping out our alignment with the new ISO20400 standard on best-practice sustainable procurement, and will set a corporate target on supplier engagement at the completion of this project.

Metrics

Alongside our broader impact and contribution sit the key metrics through which we measure our ongoing performance.

Leadership and governance

Learn more about the leadership and governance of Deloitte LLP.