These are the key findings from the 2023 Deloitte European Hotel Industry survey, conducted as part of the annual European Hotel Industry Conference. The survey took place between 18 September and 10 October 2023. The survey represents the views of a sample constituting senior figures from the hospitality industry including owners, operators, lenders, developers and investors.

Risks to the hotel industry

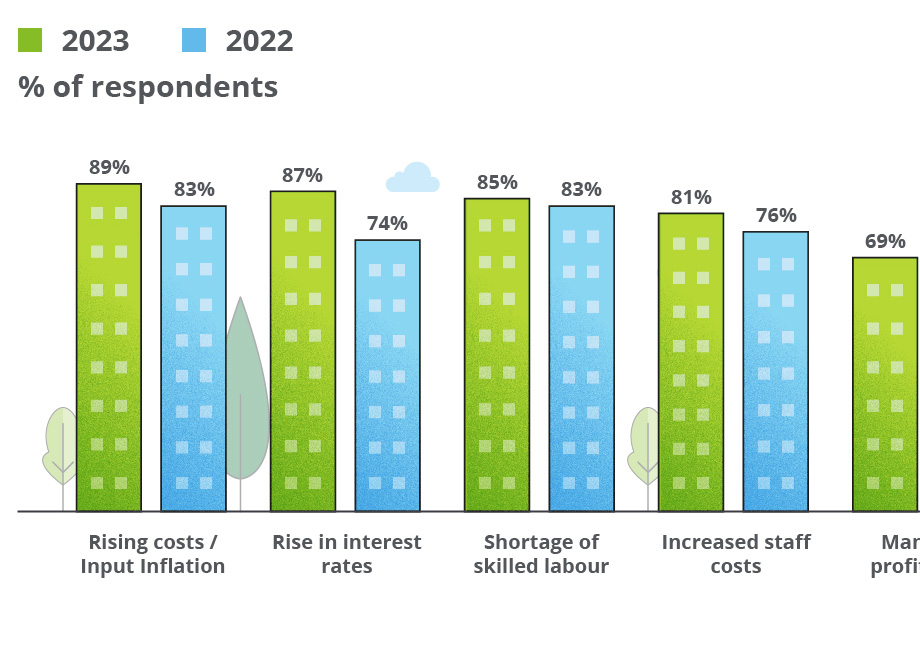

Rising costs, higher interest rates, a shortage of skilled labour and increased staff costs are cited by most executives in the hospitality sector as the top risks already hindering growth this year. Demand fluctuations (48%), the inability to raise prices (45%), Generative AI (41%) and technology disruptions (39%) are all perceived as the next key risks for the industry over a one to three-year timeframe. Meanwhile, non-compliance with the growing sustainability agenda and climate change disruptions are identified as high risks to the industry in the longer term.

Top priorities for the year ahead

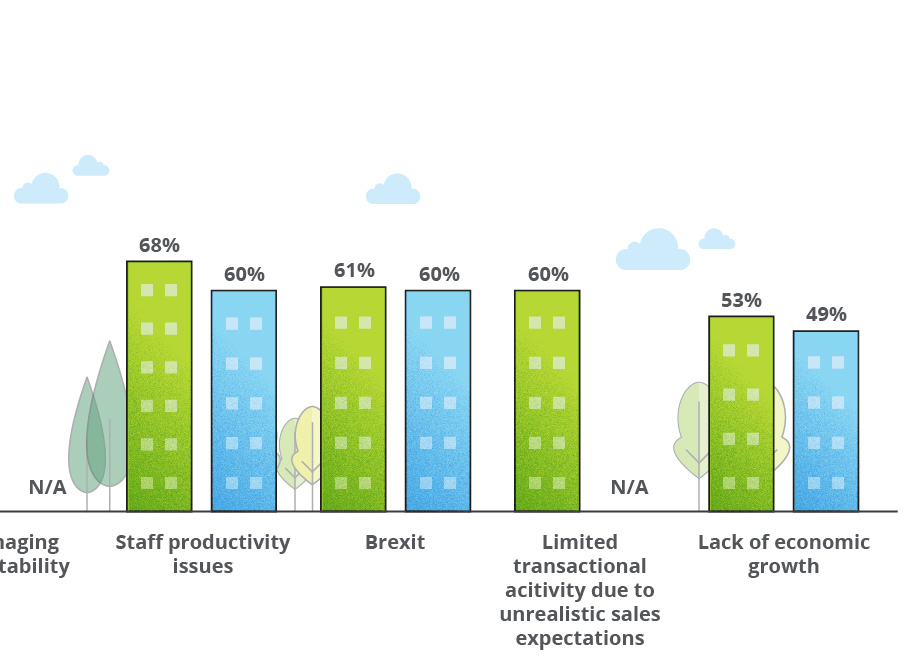

Managing inflationary pressures, maintaining profitability and increasing cashflow are the immediate priorities for most hotel industry executives over the next 12 months. Given the ongoing labour shortages experienced in the sector, hiring and retaining talent, and performance improvement also remain key focus areas for executives in the year ahead.

In a sign that deal activity could be accelerating, this year’s data shows that divestitures and acquisitions have both increased as key priorities, by 18 percentage points (to 24%) and 16 percentage points (to 58%), respectively.

With pressure on margins, there was a significant decline in the proportion of sector executives considering digital transformation as a priority this year, with only 22% mentioning it compared to 48% last year.

Generative AI

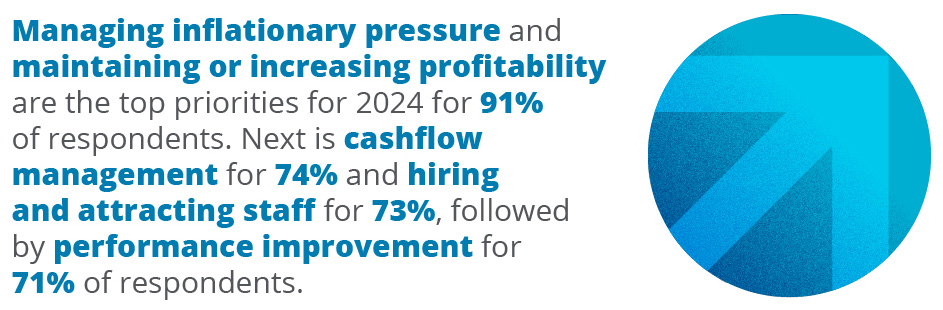

When asked about the the biggest Generative AI opportunities, respondents were more likely to view GenAI as a tool to enhance customer engagement, including to create customised marketing campaigns (56%) or provide personalised customer support (52%).

However, only one in four respondents (25%) see GenAI as a solution to support operational efficiency, such as to detect fraudulent activities or to generate new financial models.

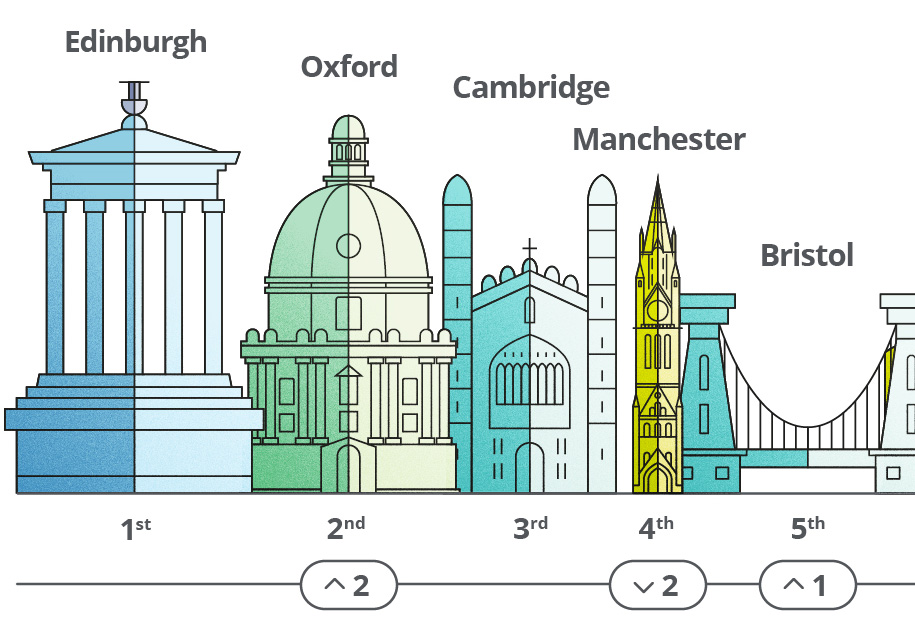

Top 10 regional UK cities for investment

Edinburgh remains the most attractive city for hotel investment in 2023 for the third consecutive year, while Oxford gained two places to become the second most attractive city in the UK. Meanwhile, Manchester, Bath, Glasgow and Aberdeen all dropped in the ranking compared with last year.

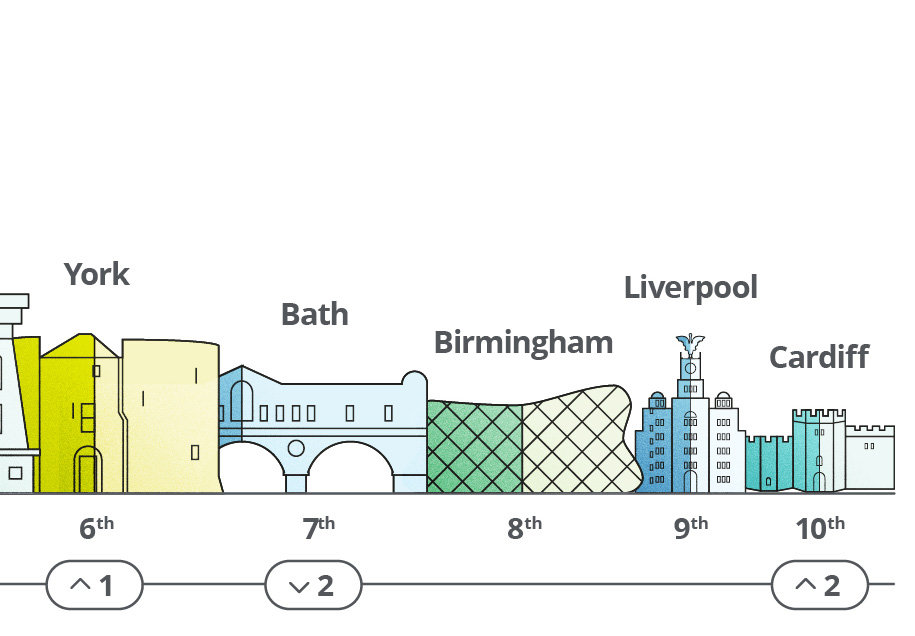

UK investment opportunities

Performance in the UK market

The majority of survey respondents (82%) expect a growth of 1% to 7% in London’s Revenue Per Available Room (RevPAR), while 72% of respondents anticipate a RevPAR of 1% to 5% in the regions this year. In a sign of normalisation post COVID, not only the number of undecided respondents is significantly lower this year, the higher RevPaR expectations for the year ahead [over 9%] have fallen compared with previous years.

The lower Gross Operating Profit per Available Room (GOPPAR) expectations for 2023 compared to the last two years are due to the pressures that high inflation, labour shortages and greater energy prices are putting on profits. As a result, over one in four respondents (28%) expect 0% or negative GOPPAR in London in 2023 and close to one in two have equally negative expectations for regional performance over the same period.

Executives were more confident about their EBITDA multiple expectations for 2023, with a lower proportion of respondents undecided this year compared with the same period a year ago. There was a spread of multiples expected across London including over one in three respondents (36%) expecting multiples of more than 15 times. For regional UK, 66% of respondents are expecting multiples between eight to 14 times.

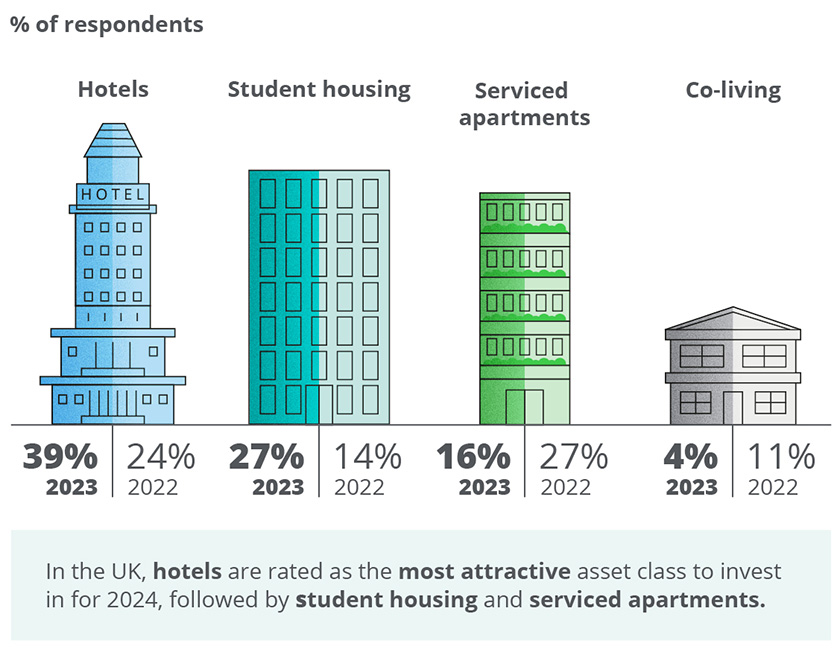

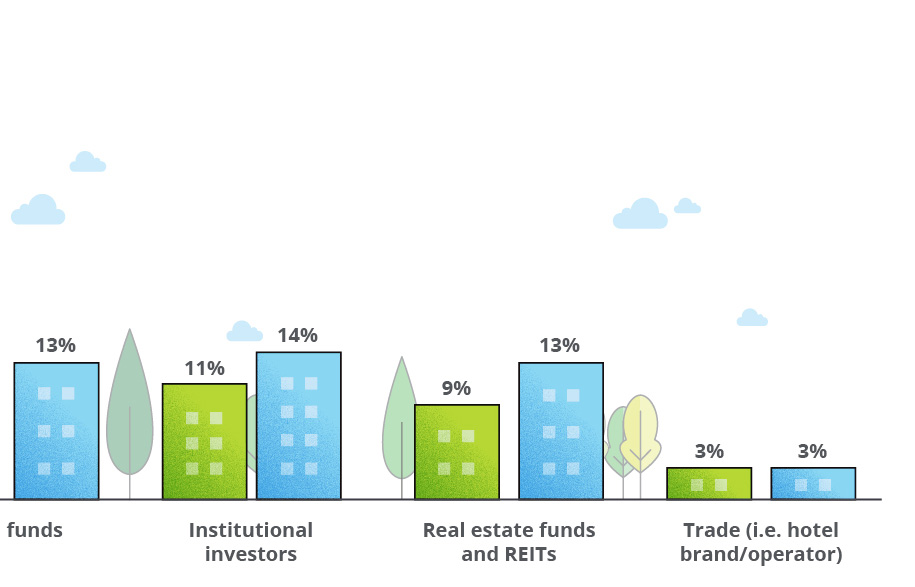

Financing the UK hotel market

Private equity is expected to be the largest source of equity capital for UK hotel acquisitions in 2023 for close to one in three respondents (29%). However, private equity investments have seen a notable decline in recent years in line with lower levels of deals taking place in the sector. As a result, other sources of investment continue to emerge including, family offices expected to be the second major source of equity capital in 2023 at 16%, followed by Sovereign Wealth Funds rising from 6% in last year’s survey to 15% this year.

In terms of which regions are likely to invest the most in the UK hotel market in 2023, for close to one in two respondents (48%) investments will come from the UK followed by North America (35%) and Europe (31%). Asia Pacific (excluding China and India) as a source of hotel investment into the UK has improved slightly this year, while the Middle East and North Africa, and China have seen modest declines.

UK outlook

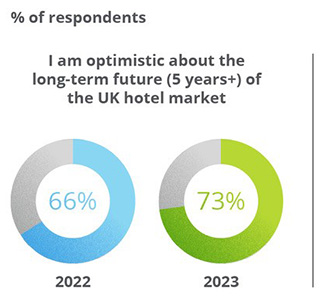

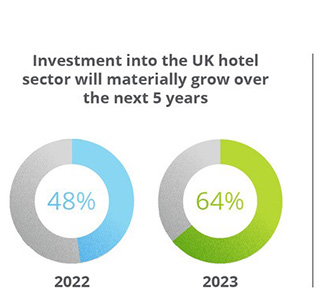

Levels of confidence in the UK hotel market have improved significantly compared with 2022. The proportion of respondents believing profitability will improve in the next five years has nearly doubled this year growing from 38% in 2022 to 64% in 2023. In addition, nearly three quarters of respondents (73%) say they are optimistic about the long-term future of the UK hotel market, compared with 66% in 2022, while 64% agree that investment into the UK will grow materially over the next five years, compared with 48% in 2022.

More respondents are also expecting a faster normalisation in the current UK investment cycle compared to 2022. This year one in four respondents (25%) think the current UK investment cycle will normalise in the next 6-12 months, up from 13% last year. In another sign of growing confidence, the number of respondents who are unsure also decreased significantly from 16% in 2022 to 5% in 2023.

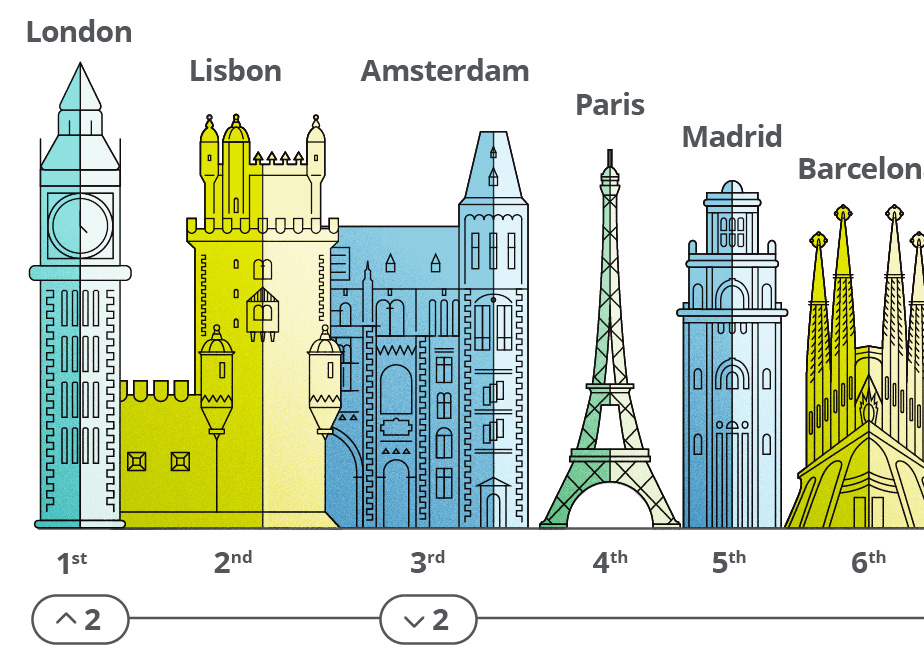

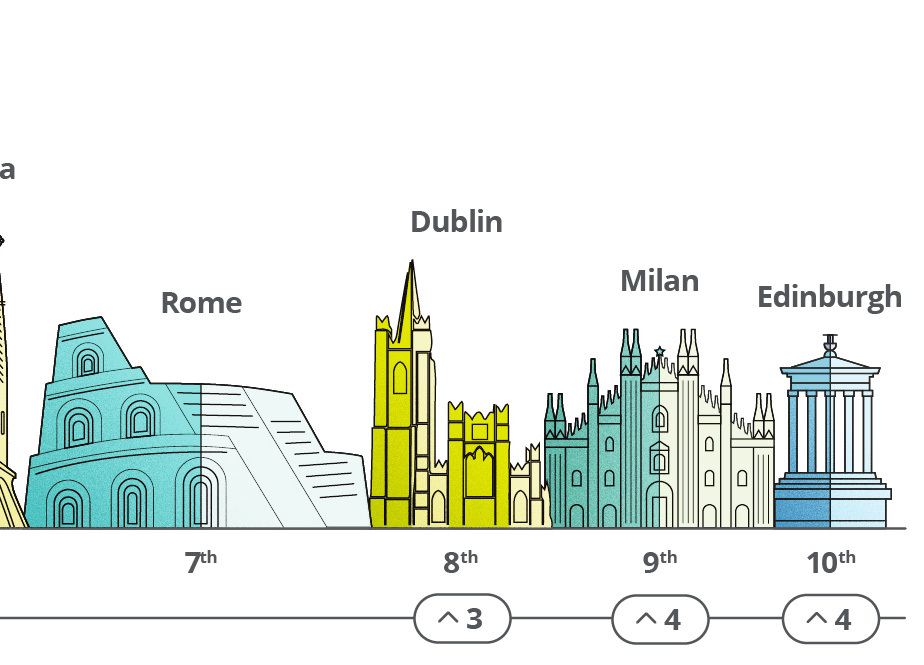

Top 10 European cities for investment

London is set to become the most attractive European city for hotel investment in 2023, moving up two places to the top spot. Lisbon retains its number two ranking, while Amsterdam falls to third place. Cities attracting more investment this year include Dublin, Milan and Edinburgh.

European investment opportunities

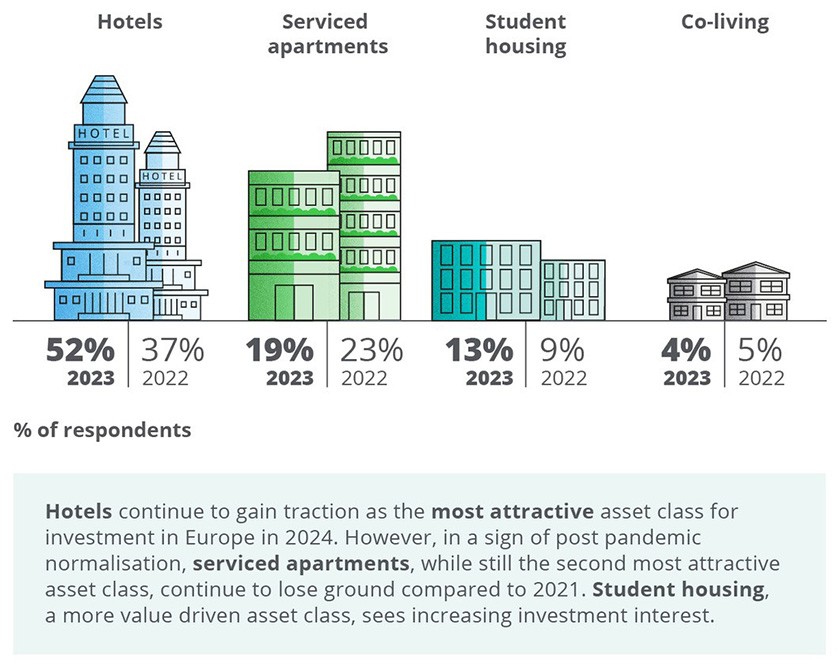

Hotels continue to be the most attractive European asset class for investment in 2023 for 52% of respondents representing a significant 15 percentage point increase on last year (37%). However, as the sector returns to normalcy following the pandemic, while serviced apartments is still the second most attractive asset class for close to one in five respondents (19%), it continues to receive less interest. Student housing, a more value-driven asset class, is expected to see increasing investment interest in 2023.

Financing the European hotel market

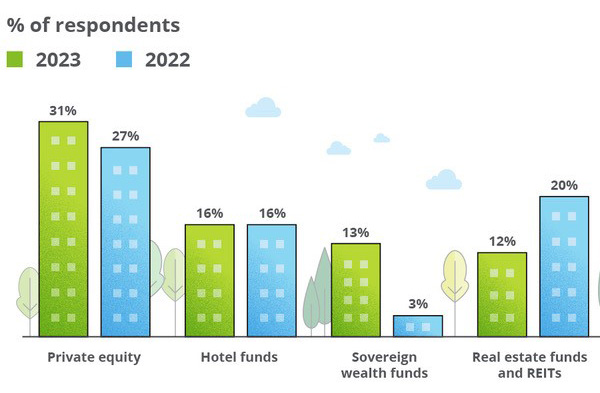

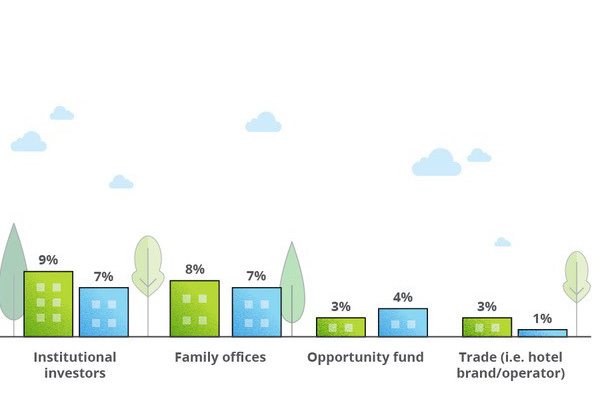

Private equity remains the main source of equity capital for hotel acquisitions in Europe in 2023, with a four percentage point increase compared with last year [from 27% to 31% this year], while sovereign wealth funds have surged by ten percentage points to become the third largest source of equity capital for hotel acquisitions [from 3% to 13% this year].

According to the respondents, alternative lenders remain the most common source of debt financing in the European hotel market in 2023, also gaining a significant 12 percentage points from 43% to 55% this year. By contrast, all other sources have lost momentum compared with the same period a year ago, except for sovereign wealth funds and vendor loans.

More than half of respondents (56%) expect hotel investment to be sourced from Europe, with funding from the UK (20%) and North America (39%) declining in significance this year due to slowing economic activity. The Middle East and North Africa’s importance as sources of investment has grown consistently in the last two years, with nearly 40% expecting investment to come from the region, a 22 percentage point increase compared with 2021. The APAC region (excluding India and China) and India are both expected to increase by exactly four percentage points in 2023, to 20% and 7% respectively. Meanwhile, China as a source of investment for 2023, is expected to decline by 11 percentage points to 4%.

European outlook and investment cycle

With the exception of the Netherlands where the investment cycle seems clearly on the upturn, the rest of the Northern Europe investment cycle is more negative, with Germany and Ireland experiencing a downturn, whereas the UK and France are undergoing a trough period, according to respondents in our survey. There is more certainty in the Southern European investment cycle with most Mediterranean markets proving to be on the upturn following more consolidation in the region. Portugal, particularly, emerges as the country where close to one in two respondents (47%) feel the investment cycle is on the rise.

Contacts

-

Simon Oaten

Lead Partner, Hospitality & Leisure, Deloitte UK

View profile

-

Leila Jiwnani

Hospitality Advisory Lead, Deloitte UK

View profile

-

Anjusha Chemmanur

Senior Manager, Travel, Hospitality & Leisure Advisory, Deloitte UK

View profile

-

Céline Fenech

Insight Manager, Consumer Industry, Deloitte UK

View profile