“In Q1 2018, not only was radio ad spending in the UK up 12.5% year over year, but radio advertising was the fastest-growing type of advertising, outpacing even internet advertising.”

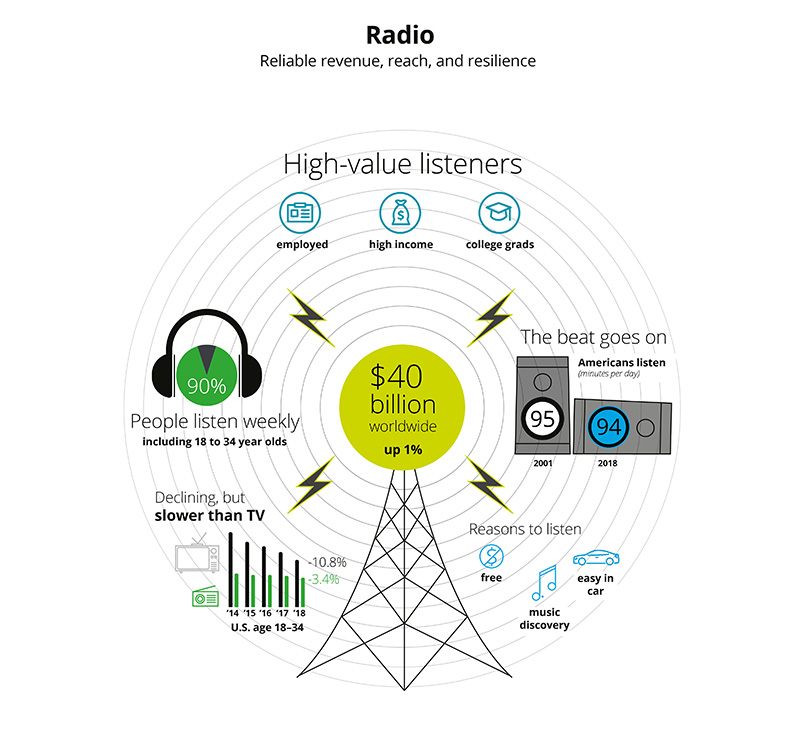

The key trends that Deloitte predicts for radio are:

- In 2019, global radio revenue1 will reach £31.6 billion, a 1% increase over 2018.

- Radio’s weekly reach will remain nearly ubiquitous, with over 85% of the adult population listening to radio at least weekly in the developed world (the same proportion as in 2018). Combined, nearly 3 billion people worldwide will listen to radio at least weekly.2

- Adults in developed countries will listen to an average of 90 minutes of radio a day, similar to 2018.

- Finally, we expect that unlike some other forms of traditional media radio will continue to perform well among younger demographics. Radio is likely to reach 90% of adults in the UK on a weekly basis in 2019, similar to prior years.

Figure 1. Weekly radio reach in UK

Source: Ofcom, Communications market report 2018

Who is listening to the radio?

The vast majority (83%) of 15-24 year olds in the UK listen to radio. The proportions are yet higher among 25-34 year olds (88%) and 35-54 year olds (94%). Radio listening remains far more popular among all age groups than on-demand services, usage of which peaks at 39% among 15-25 year olds (see Figure 2).

Figure 2. Audio reach by age group

Source: RAJAR Midas audio survey, Spring 2017

How does radio reach stay stable?

Radio’s resilience is largely due to its role as a background accompaniment to existing activities. Nearly 60% of all adults listen to the radio while driving or travelling. At home, one in every three radio listeners does so while doing another physical task, such as cooking, eating or doing household chores. Radio may also be in the background even when playing video games or shopping.

Figure 3: Live radio by activity

Source: RAJAR Midas audio survey, Spring 2017

In Q1 2018, not only was radio ad spending in the UK up 12.5% year over year (after a lengthy period of decline), but radio advertising was the fastest-growing type of advertising, outpacing even internet advertising.

When considering radio’s attractiveness to advertisers, it is important to note that radio’s popularity varies significantly from country to country in both reach and revenue generated per capita (see Figures 4 and 5). Interestingly, there seems to be no clear correlation between radio reach in each country and industry revenues.

Figure 4. Annual radio revenue per capita, 2017, (GBP)

Sources: The International Communications Market 2017, Ofcom, December 18, 2017; Canadian Radio and Telecommunications Commission data; Statista.

Figure 5. Weekly radio reach by country, 2017

Sources: The International Communications Market 2017, Ofcom, December 18, 2017; Nielsen for the United States; Numeris for Canada.

By some metrics, radio compares favourably to TV. For example TV watching in U.K. by the youngest demographic has decreased 42% since 2010. Radio has no such existential crisis or looming demographic cliff. In 2017, radio attracted about 6% of global ad spending (about 9% in North America), and in 2019, it will likely be around 6% again.

1. Radio is defined as AM/FM broadcast, both digital and analogue, satellite radio, and internet streams of AM/FM radio. Revenue includes advertising revenues, subscription fees, and public license fees where those exist.

2. With over a billion people in the developed world, radio’s reach will be about 900 million. Its 98 % reach in China adds another billion. The rest of the developing world of 4 billion will have at least another billion listeners, although we do not have exact reach data for all of them.